Buying a home is the largest purchase we are likely to make. Getting onto the property ladder can be a big step. Where should we live? Which property should we make our home? How will we pay for it?

SAVING FOR A DEPOSIT

If you’re a first-time buyer, you need to save for a deposit before looking at properties. Generally, you need to try to save at least 10% to 20% of the cost of the home you would like (although see the news about government-backed 95% mortgages in the Latest Budget Updates chapter above.) Saving more than 10% will give you access to a wider range of cheaper mortgages available on the market. As a first-time home buyer, the most important thing to bear in mind is whether you can really afford to take this step. It’s wise to put together a budget before you start looking for a property. If you are planning to buy in a few years’ time why not use a Lifetime ISA to help with the deposit?

LOCATION, LOCATION, LOCATION

It’s a good idea to write down what you want from a home and list it in order of priority. You need to think about where you want or need to live, what type of area you’d prefer, and the size of the property you want or need. You also need to get a feel for an area to check it suits your lifestyle. Find out about transport links and parking, where shops and green spaces are, how busy the area is, and how far you’d be from friends and relatives. In addition, consider how critical the location is relative to local schools, the hospital, commuting distance to your work, accessibility to public transport, and closeness to family and friends. Think about what’s going to be most important to you in an area: a low crime rate? Proximity to pubs, restaurants and entertainment?

MORTGAGE AGREEMENT IN PRINCIPLE

When you put an offer on a property, you can show estate agents you’re serious about buying by obtaining an ‘agreement in principle’ (AIP) from a lender. The AIP states the amount the lender is likely to lend you. It’s not a legally binding agreement, as it’s subject to a valuation of the property, but you send in any evidence the lender requires, such as payslips. You shouldn’t ask many lenders for an AIP, as it requires a credit check against your credit file. The credit check leaves a footprint which can be seen by other lenders on your file and may affect your ability to get credit.

At CCFS to make an agreement in principle, we will ask you for:

- proof of your employment and income, e.g. your most recent payslips & P60

- proof of your identity and address

- copies of your bank statements for the last three months

- confirmation of your deposit

- if sole-trader, last 3 years’ tax calculation and tax year overview

- if you run a Ltd company, last 3 years’ tax calculation and tax year overview plus last 3 years’ closed company accounts

We understand that not all brokers will ask for this much information, but at CCFS we want to make sure that we have a complete picture of your finances before submitting for an initial decision from the bank.

We do not want to be in a position where the initial decision is accepted for it later to be declined because we didn’t fully understand our client’s circumstances.

LEGAL MATTERS

A conveyancer deals with the legal side of buying a property. They arrange the transfer of ownership by drawing up and exchanging contracts with the seller’s conveyancer (or ‘concluding missives’ in Scotland). They also arrange the payment of Stamp Duty Land Tax or Land (or Buildings

Transaction Tax in Scotland), and conduct legal searches, including local authority, water, drainage and environmental searches and register the property title in your name. In Wales, England and Northern Ireland, you appoint a conveyancer once your offer is accepted on a property. In Scotland, you appoint a conveyancer before you make an offer on a property, as they are responsible for placing the offer on your behalf. A survey should point out any major issues with the condition of the property. If it brings up problems you’re not aware of, you could ask the seller to reduce the sale price or fix the problems before exchange of contracts. If they’re not willing to do this, you may need to reconsider your options.

MAKING AN OFFER

Before you make an offer on a property, you should ask the estate agent if the seller is ready to move. Have they found another property to move to and secured a mortgage? Have they received any other offers? Which fixtures and fittings are included in the price? In Wales, England and Northern Ireland, you can make an offer directly to the estate agent. You can let them know you’re serious about buying the property by having a mortgage approved in principle, and advising that you want to move quickly. If the seller rejects your offer, if you can afford to, you can increase it. Once your offer is accepted, ask the estate agent to confirm it in writing and take the property off the market. At CCFS we will happily talk directly with an agent to confirm our client’s position. We will make sure that the agent understands the seriousness of our offer and that we are ready to move with the purchase.

Remember: Estate agents do not work for a buyer so it does not matter how nice they are. They will be even nicer to clients who have put a bigger offer to buy “your home”. This is regulated by the contract which an agent signs with the seller, to sell the property at the highest possible price.

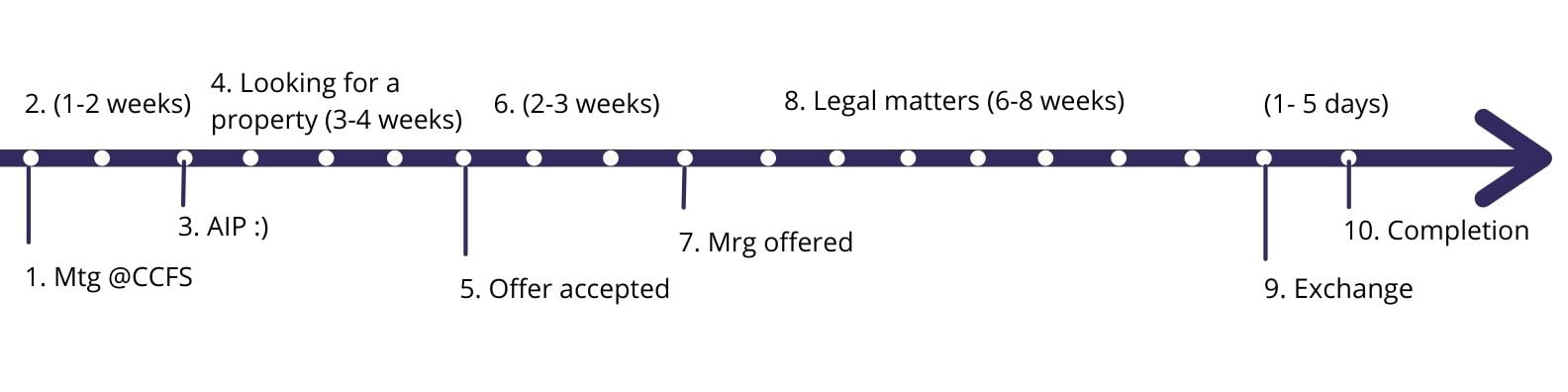

TIME FRAME

How long will it take before I get my keys? – this is the most asked question when meeting first-time buyers. It really all depends on both seller and buyer but generally, anything between 2 to 4 months, with 3 months being average. Please see the timeline below, which demonstrates best your journey during the buying process.

- Meeting clients.

- Client accepts our service and sends us all appropriate documents to complete agreement in principle.

- Agreement in principle is approved and clients are notified.

- Clients make an offer on their dream home.

- Offer accepted

- Convert initial agreement in principle into full mortgage application.

- Mortgage offer approved.

- Legal matters - you can start those before mortgage is approved or once mortgage is offered.

- Exchange of contracts,

- Completion. This is when you get your keys.

How can we help?

When I meet with First Time Buyers they are usually a bit lost and not sure what to do and when. We reassure every client from the start that they are our number 1 priority. Each client has my mobile number to call me at any time about any aspect of the process.

Our service takes prospective buyers by the hand to lead them through every step of the buying procedure from start to finish. It is most important to have somebody you can count on who will not let you down. Do not “hope” for this transaction to go smoothly. Make sure that the financial professional you work with knows their trade and they are transparent and honest with you. Our service can be summed up via the diagram below .

- Clients - top priority for CCFS.

- Estate agent - we make sure they are happy.

- Bank - we recommend the most appropriate one.

- Valuation - we manage this aspect to make sure it is done on time.

- Legals -we liaise with your solicitor to make sure the transaction is moving.

- Clients - we keep you constantly informed.

- Keys - we always aim to achieve our clients’ main goal, which is getting the keys to their new property.

Download the full Guide:

Submit a Comment