Understanding the persistent decline of the British pound and its implications for businesses and professionals.

The Impact of Brexit and Political Uncertainty

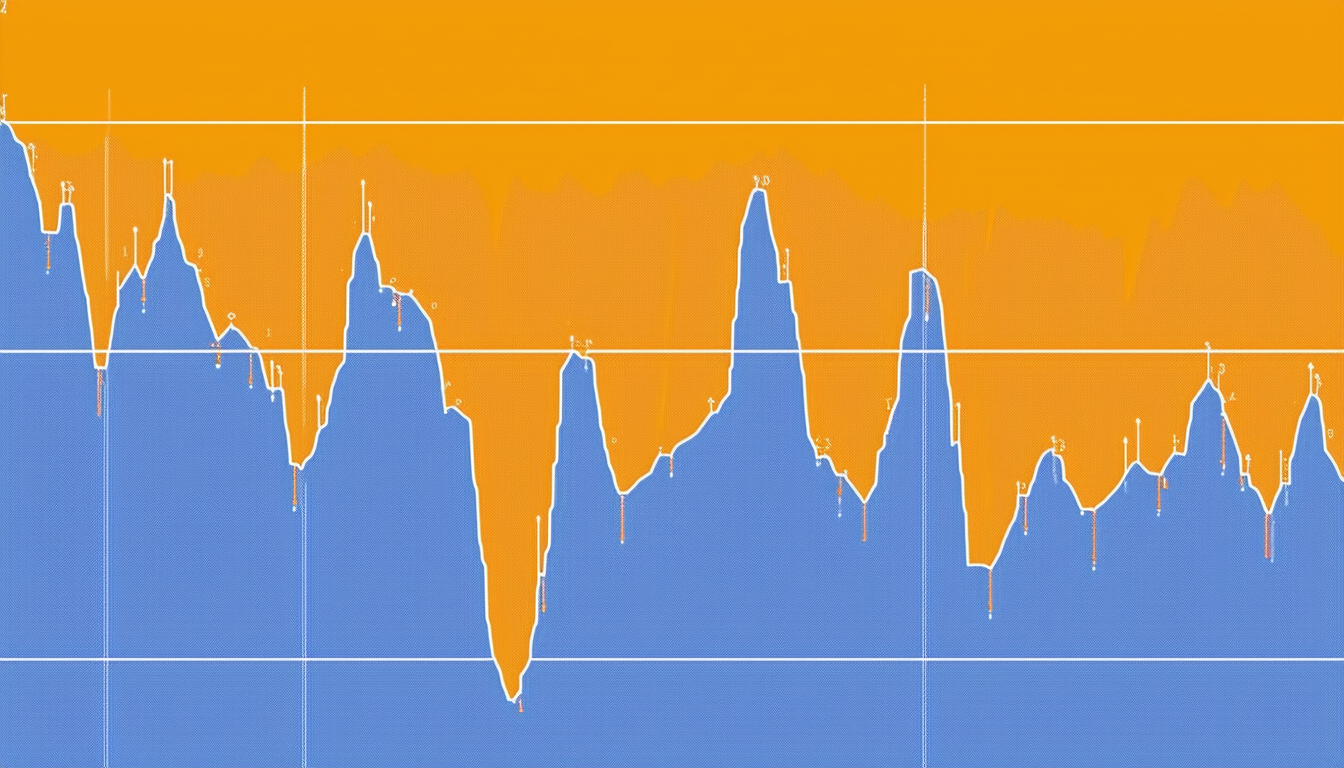

The 2016 Brexit referendum marked a significant turning point for the British pound (GBP). The immediate aftermath saw a sharp decline in GBP value, driven by uncertainty over future trade and economic policies. This uncertainty persisted through prolonged Brexit negotiations, causing fluctuations in investor confidence.

Political instability has also played a role in weakening the GBP. Leadership changes and shifting policies have injected volatility into the market, further eroding confidence in the currency. The continuous state of flux in the UK’s political landscape has made it difficult for businesses and investors to plan long-term, contributing to the currency's decline.

Economic Growth and Productivity Challenges

The UK's economic growth has lagged behind other major economies, particularly the United States. Slow growth rates have naturally led to a weaker currency. Structural issues in key industries, such as manufacturing and services, have compounded these challenges, resulting in low productivity growth.

Business investment has also been sluggish, reflecting a lack of confidence in the economic outlook. This reduced investment hampers long-term economic prospects, creating a vicious cycle that further weakens the GBP. Addressing these structural and productivity issues is crucial for any long-term recovery.

Inflation and Interest Rate Dynamics

High inflation has been another significant factor eroding the real value of GBP. The UK has faced higher inflation rates compared to historical trends, driven by supply chain disruptions and rising energy costs. As inflation rises, the purchasing power of GBP decreases, making it less attractive to investors.

While the Bank of England (BoE) has raised interest rates to combat inflation, it has not been as aggressive as the US Federal Reserve. This interest rate differential makes the US dollar more appealing to investors, thereby weakening the GBP in comparison.

Trade Imbalance and Foreign Investment

The UK runs a trade deficit, meaning it imports more than it exports. This imbalance puts downward pressure on the GBP as more pounds are exchanged for foreign currencies to pay for imports. A persistent trade deficit can lead to a sustained weakening of the currency.

Additionally, foreign investment in UK assets has declined compared to levels seen in the early 2000s. Reduced foreign investment lowers demand for GBP, further contributing to its depreciation. Reversing these trends would require making the UK a more attractive destination for foreign capital.

Global Market Trends and External Shocks

Global market trends have also played a role in the weakening of the GBP. The US dollar has strengthened globally due to its status as a safe-haven currency, especially during crises like COVID-19 and geopolitical tensions. When investors seek safety, they often turn to the US dollar, making other currencies, including the GBP, appear weaker.

External shocks, such as the COVID-19 pandemic and the 2022 energy crisis caused by the Russia-Ukraine war, have further strained the UK economy. Increased import costs and slower recovery in key sectors have exacerbated inflation and weakened the GBP. These global factors demonstrate the interconnectedness of economies and the external pressures that can impact a currency.