International advisory company JLL presents H1 summary and the key trends for the coming months for Poland's industrial market.

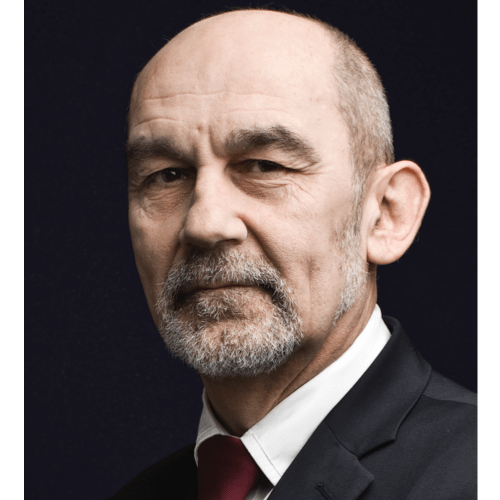

Tomasz Olszewski, Head of Industrial CEE, JLL, said: “The symptoms of economic recovery have had a positive impact on demand for industrial space. After a successful 2013, when gross demand for industrial facilities across Poland totalled 1.89 million sq m, the market has not displayed any signs of deceleration in 2014. In the first half of 2014, gross take-up stood at 912,000 sq m, of which 526,000 sq m was in new contracts. Assuming that the next two quarters will not experience any major slowdown, a total of 1 million sq m will be leased to new tenants in 2014. Once again the market has been primarily driven by logistics operators. In addition, we also see an increasing share of space being designated for the growing e-commerce sector”.

With 245,000 sq m of leased space, the Warsaw Suburbs accounted for 28% of gross demand. A further 18% was attributable to the Upper Silesia region. It is noteworthy, however, that the aforementioned regions are in fact driven largely by lease renewals, which are a feature of mature markets. In terms of new demand, the most sought-after regions included Poznań (new leases of 103,000 sq m) and Wrocław (87,000 sq m).

Once again, the highest demand came from logistics operators, whose new leases totalled more than 254,000 sq m, which is 48% of entire net demand. However, the largest single transaction involved a retail chain for which Goodman will deliver a 40,000 sq m project near Konin.

The average transaction in H1 2014 was for 4,700 sq m.

Vacancy rate – no significant changes

According to warehousefinder.pl, since the end of 2011, the vacancy rate registered on the Polish market has ranged between 10% and 12%. At the end of H1 2014, it stood at 10.5% (817,000 sq m). Among the five largest markets, the highest vacancy rate continues to be found in Central Poland (17.2% – 203,000 sq m). In the Piotrków Trybunalski area alone tenants can choose from 102,000 sq m of empty industrial space.

The lowest availability of warehouse space is to be found in Western Poland. Both in Poznań and Wrocław vacancies are slightly over 50,000 sq m (4.7% and 6.2%, respectively). Moreover, the fact that this floor space is located in numerous parks causes difficulties for tenants seeking larger areas. These tenants often need to consider working with a developer on the delivery of a brand new scheme.

Developer activity – 85% increase in new supply

During the first half of 2014, developers delivered 298,000 sq m of new supply. This figure is 85% larger than H1 2013's total, when the market expanded by only 161,000 sq m. The largest completions so far in 2014 have involved a BTS for Castorama in Stryków (50,000 sq m), the extension of Prologis Park Wrocław V (35,000 sq m), and a BTS project for Polaris completed in Opole. Panattoni was the most active of all developers in the first half of 2014, delivering 108,000 sq m of space, which amounts to a 36% share of total completed stock. MLP ranked second with 43,000 sq m (14%), followed by Prologis (35,000 sq m – 12%).

“During the last 12 months, construction activity has increased rapidly. At the end of H1 2013, nearly 250,000 sq m was under construction. Today, developers are in the process of delivering as much as 811,000 sq m of new market stock. This is the largest amount seen on the market since the beginning of the financial crisis in 2008. The vast majority of space under development will be delivered this year, meaning that the entire supply onto Poland’s industrial market is expected to be more than 8.6 million sq m. Furthermore, another sign of the market's buoyancy is that the number of speculative projects is on the increase. Almost 80,000 sq m is now being delivered without any binding lease agreement, the highest volume since the end of 2009. This is the developers’ answer to the increasing demand and improving economic landscape”, Tomasz Olszewski added.

The largest project under way in Poland is for Amazon, with three buildings with a total floor space of 324,000 sq m being constructed in Wrocław and Poznań. Other noteworthy projects include an 82,000 sq m warehouse for ITM by Goodman near Poznań ,and the previously mentioned building near Konin, which is being developed by Goodman for a tenant from the retail sector. Panattoni and Goodman have the largest amounts of construction activity among all developers (315,000 sq m and 282,000 sq m, respectively). SEGRO is ranked third, with almost 77,000 sq m now at the development stage.

In terms of the ownership structure of the Polish industrial market, more than half of existing floor space is in the hands of the three largest market players and their partners. The largest share of stock is owned by Prologis (26%), followed by SEGRO (13%) and Blackstone (12%). The largest amount of growth was registered by Blackstone: its share has increased from 10% to 12% since the end of Q1 2014. Fourth spot was taken by Panattoni, the most active developer but whose share accounts for barely 5%, a situation stemming from the company’s strategy, which features the disposal of completed projects.

Rents remain stable

The first half of 2014 did not see any major changes in effective rents. Interestingly, even on the most mature markets, such as Poznań, developers and landlords did not demand increases in rents, as that could have a negative impact on their efforts to secure key tenants. Current effective rents in Poznań range between €2.25 and €3.3 / sq m / month. The Warsaw Suburbs market offers space from €2.1 to €2.8 / sq m / month, and the second largest industrial region – Upper Silesia – from €2.4 to €3.3 / sq m / month. In Central Poland tenants must be ready to pay from €2.1 to €2.8 / sq m / month and in Wrocław from €2.5 to €3.1 / sq m / month.

Industrial land – increase in demand for plots in SEZ

Agata Zając, Land Transactions Coordinator, JLL, said: “In the analysed period the demand for industrial land increased, especially those in Special Economic Zones. The main factor affecting developers’ interest was the announcement of a change in the granting of regional aid in SEZ. New regulations, effective from 1 July, reward investments in the eastern part of the country. This is why many companies, who intend to take advantage of the old rules, approached the SEZs in order to gain valid permits, resulting in a record high demand in H1 2014. The development of a modern road network remains a key driver determining the geography of demand for industrial land. For example, on the Warsaw market, developer interest is gradually shifting to the area of the S8 expressway, currently under construction. The highest prices for industrial plots are in Warsaw Inner City – 350 – 550 PLN per sq m”.

Check our blog post Polish Builders in London.

Source: BPCC