Securing a mortgage as a self-employed individual can present unique challenges compared to traditional employed workers. Lenders often have stricter criteria and require more documentation to assess the financial stability and income of self-employed individuals. However, with the right knowledge and preparation, it is possible to navigate the mortgage process successfully.

Understanding the Challenges

- Income Fluctuations: Self-employed income can be less consistent than a traditional salary, which may raise concerns for lenders.

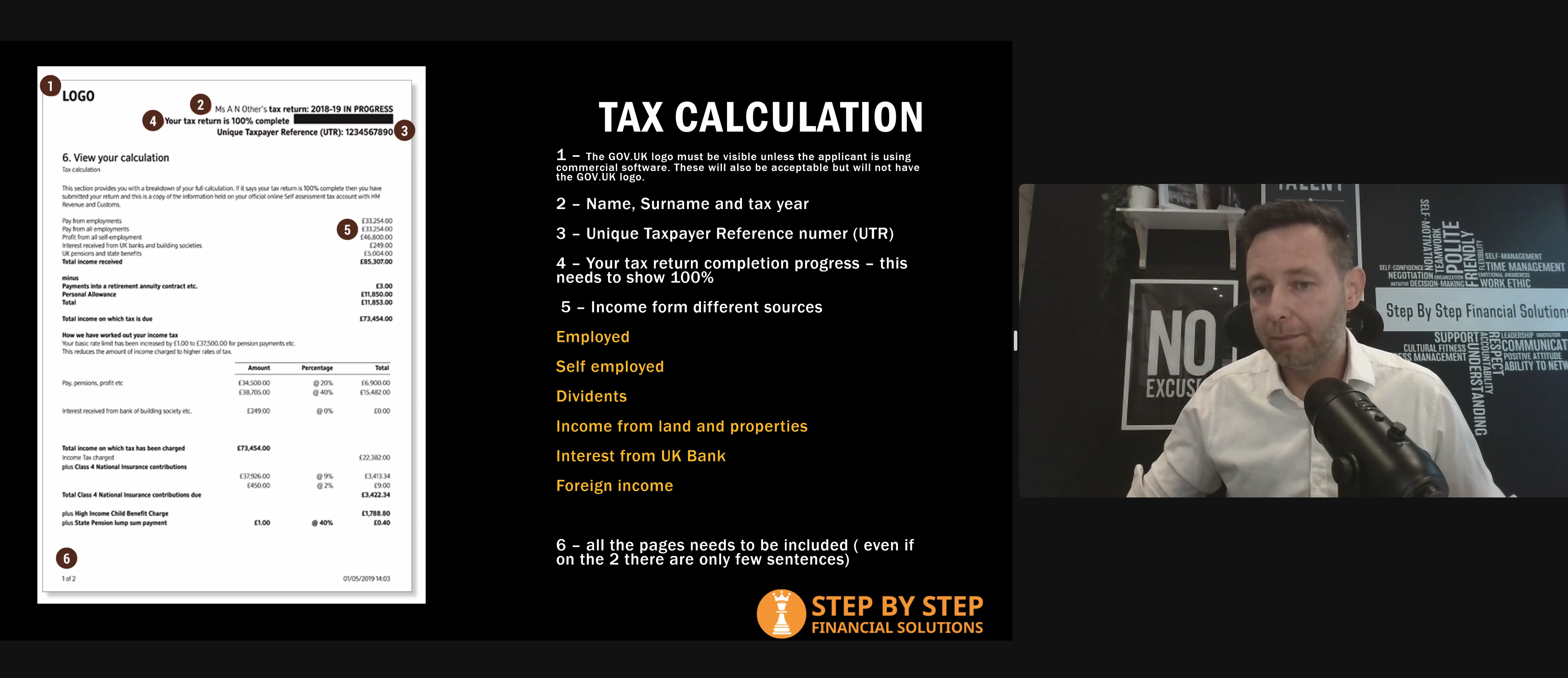

- Document Requirements: Lenders may require additional documentation, such as tax returns and business accounts, to assess your financial situation.

- Perceived Risk: Some lenders may view self-employed individuals as higher risk due to the inherent variability of their income.

Key Eligibility Criteria

- Trading History: Lenders generally require at least two years of trading history to assess the sustainability of your business.

- Income: Your income will be a primary factor in determining your mortgage affordability. Lenders will typically assess your average income over the past two to three years, taking into account factors like salary, dividends, and net profit.

Preparing for Your Mortgage Application

- Gather Necessary Documents: This may include:

- Tax returns for the past two to three years

- Business accounts, including profit and loss statements and balance sheets

- Bank statements

- Accountant's certificate (if applicable)

- Understand Your Financial Situation: Assess your income, expenses, and debt levels to get a clear picture of your financial health.

- Plan Ahead: Start planning your mortgage application well in advance to ensure you have all the necessary documents ready.

Common Misconceptions

- Higher Interest Rates: While it was once common for self-employed individuals to face higher interest rates, this is no longer always the case. Many lenders now offer competitive rates for self-employed borrowers.

- Difficulty Obtaining a Mortgage: While it may require additional effort and documentation, securing a mortgage as a self-employed individual is certainly possible. Working with a knowledgeable mortgage broker can significantly increase your chances of success.

Tips for Success

- Consult a Mortgage Broker: A mortgage broker can help you understand your options, navigate the application process, and find the best lender for your circumstances.

- Maintain Financial Discipline: Lenders will be looking for a consistent and reliable income stream. Maintain good financial habits and avoid excessive debt.

- Be Transparent: Provide accurate and complete information to your lender. Any inconsistencies or omissions could delay the application process.

- Consider Alternative Options: If you're struggling to meet the traditional mortgage criteria, explore alternative options like guarantor mortgages or specialist lenders who cater to self-employed individuals.

Conclusion

Securing a mortgage as a self-employed individual may require additional planning and preparation, but it is certainly achievable. By understanding the key factors involved, gathering the necessary documentation, and working with a qualified mortgage broker, you can increase your chances of successfully navigating the mortgage process and achieving your homeownership goals.