If you are self-employed, you may find you have been affected by an HMRC system error which could mean a higher tax bill in January. Self-assessment...

Continue ReadingWhat's Next

Bright Grahame Murray welcomes new talent with latest graduate intake

By

Bright Grahame Murray on 10 September, 2019

A group of six graduates have taken their first steps on the Chartered Accountancy ladder after securing posts with Bright Grahame Murray.

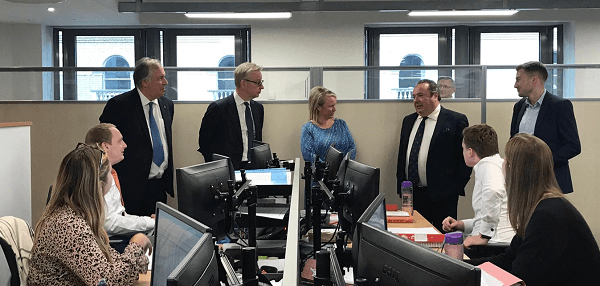

Continue ReadingMichael Gove MP and Felicity Buchan visit Bright Grahame Murray

By

Bright Grahame Murray on 31 August, 2019

From left to right: Maddie Bushell, Hugo Meakin, John Cripps, Michael Gove, Felicity Buchan, Mark Cole, Matt Higgins, Stuart Graham, Joanna Paisley

Continue ReadingCould you be using simplified expenses?

By

Bright Grahame Murray on 29 August, 2019

You can use the ‘simplified expenses’ rules when calculating allowable business expenses. They are associated with the cash basis for accounting but...

Continue ReadingEmployment in the spotlight

By

Bright Grahame Murray on 28 August, 2019

Employment regulations have been overhauled in a variety of ways over the past year, with implications for most businesses and employees. From April...

Continue ReadingVAT reverse charge for building and construction from October

By

Bright Grahame Murray on 8 August, 2019

New rules come into force in October for VAT-registered firms reporting under the Construction Industry Scheme (CIS) as part of HMRC’s attempt to...

Continue Reading