In Partnership with How Do You Reassure Self-Employed Buyers That They Can Still Get a Mortgage in London? Many entrepreneurs and self-employed...

Continue ReadingWhat's Next

PractiPol October 2025 Update – Supporting Safer Workplaces Across UK

By

PBLINK Editor on 27 October, 2025

PractiPol, a member of the Polish Business Link, continues to lead the way in practical health and safety consultancy – helping organisations across...

Continue ReadingWhat Documents Do First-Time Buyers Need for a Mortgage in London?

By

PBLINK Editor on 22 October, 2025

In Partnership with

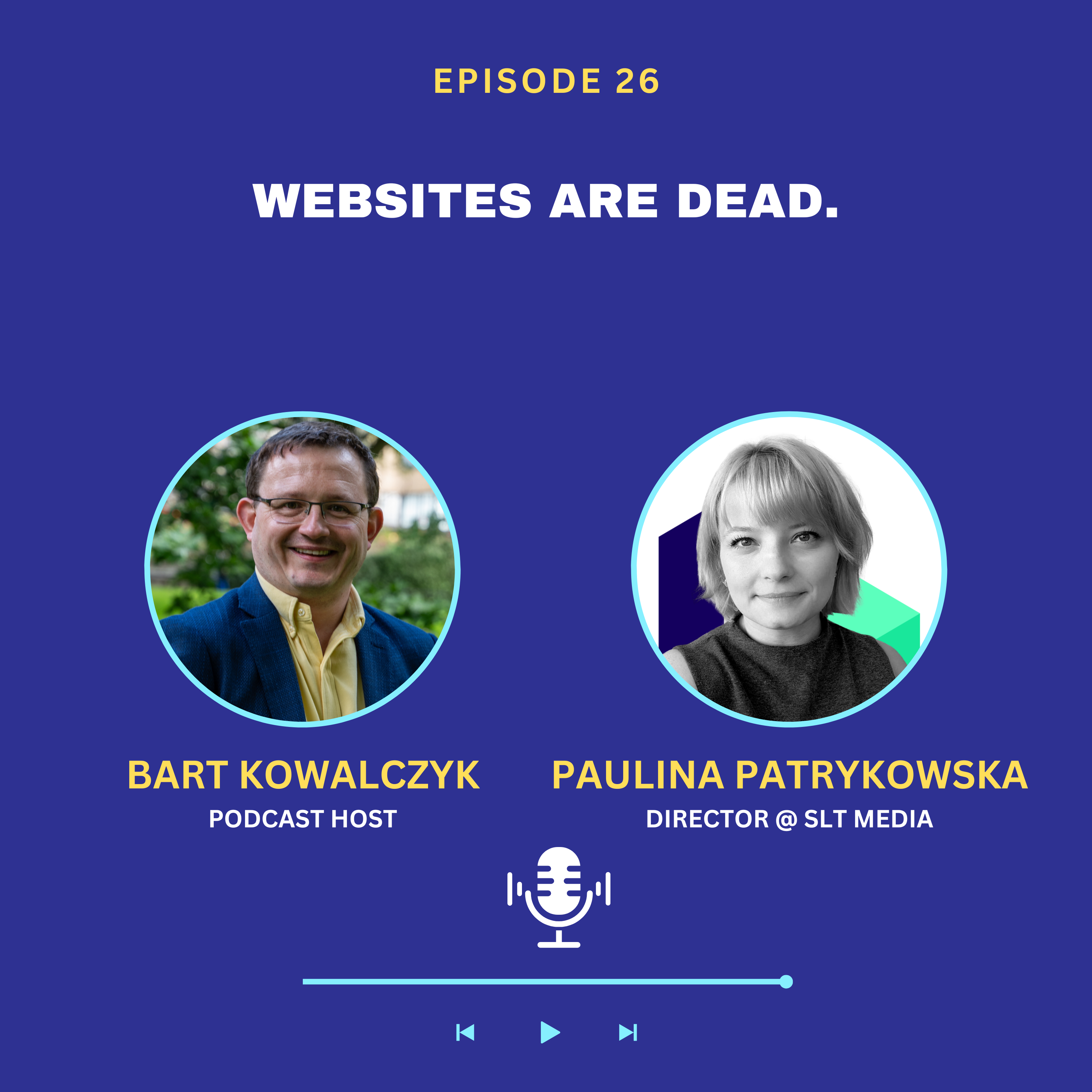

Continue ReadingWebsites Are Dead? Lessons from Paulina Patrykowska

By

Bart Kowalczyk on 21 October, 2025

In this episode of the Polish Business Podcast, Bart Kowalczyk sits down with Paulina Patrykowska, Managing Director of SLT Media — a creative agency...

Continue ReadingHow is buying your first home in London different from elsewhere in UK

By

PBLINK Editor on 14 October, 2025

In Partnership with Understanding the London Property Market The London property market is one of the most competitive and expensive in the United...

Continue ReadingEU Settlement Scheme in 2025: Key Changes for Polish Nationals

By

PBLINK Editor on 29 September, 2025

It is now five years since free movement between the UK and the EU came to an end. For Polish citizens - still the largest EU community in Britain -...

Continue Reading